The information presented here may be incomplete or out of date. BooksTime is not responsible for your compliance or noncompliance with any laws or regulations. This part of the company’s functioning is one of the most important. The correct organization of bookkeeping will allow an entrepreneur to avoid penalties, which are enforced by regulatory authorities in case of violations.

Trial balance: Definition, purpose, and example

Thomas Richard Suozzi (born August 31, 1962) is an accomplished U.S. politician and certified public accountant with extensive experience in public service and financial management. He is known for his pragmatic approach to fiscal policy and governance. Specify the ledger for the selected data access set.Ledger is required for all general ledger reports. Enter the data access set that you can access basedon the defined security structure. If you spend money on something, you gain the same value in assets, however much these actually may be worth.

What is the purpose of a post-closing trial balance?

- In addition, to ensure no more temporary or nominal accounts(revenue, expenses, withdrawal) exist before the books forward to the next year.

- The post-closing trial balance highlights only these permanent accounts, which are crucial for understanding a company’s equity.

- In conclusion, a post-closing trial balance is an important financial report for a company to ensure that all temporary accounts have been closed and the books are balanced.

- The information presented here may be incomplete or out of date.

- A post-closing trial balance is a report that lists all the balance sheet accounts with non-zero balances at the end of an accounting period.

If they aren’t, Trial balances can adjust the information so that each debit entry is balanced out by a credit entry. In the modern bookkeeping and accounting world, all the closing entries and the Trial Balances themselves are no longer done on paper. Instead, the bookkeeper prepares them using special accounting software. Moreover, many what is the liability to equity ratio of chester programs allow automizing a big chunk of this work and the bookkeeper just needs to review the information to ensure its accuracy. Doing so ensures that the company’s financial statements accurately reflect the financial position of the company. This report provides a snapshot of the company’s financial position after the closing entries.

Key Insights

Before computers, a ledger was the main tool for ensuring debits and credits were equal. A key part of ensuring accounting accuracy is the trial balance. A post-closing trial balance is a trial balance which is prepared after all of the temporary accounts in the general ledger have been closed. Like more trial balances, the debit and credit columns are totaled at the bottom to ensure the accounting equation is in balance.

Types of Trial Balances

The accountant may prepare a series of adjusted trial balances, making a number of adjusting entries before closing the books for the month. Accounting software requires that all journal entries balance before it allows them to be posted to the general ledger, so it is essentially impossible to have an unbalanced trial balance. Thus, the post-closing trial balance is only useful if the accountant is manually preparing accounting information. For this reason, most procedures for closing the books do not include a step for printing and reviewing the post-closing trial balance. This is one of the last steps in the period-end closing process. The financial reporting world relies on accurate ledgers and balances.

Income Summary is then closed to the capital account as shown in the third closing entry. If it turns out your debit amount is bigger than your credit amount when the period runs out, it means there’s been a technical mistake. If all the entries are represented properly, it’s impossible for this to happen. As discussed above, the temporary and nominal accounts are absorbed by the capital account(Spare Part Company, Capital).

A post-closing trial balance is a report that lists all the balance sheet accounts with non-zero balances at the end of an accounting period. The primary purpose of this trial balance is to ensure that the ledger accounts are balanced and ready for the next accounting cycle. A post-closing trial balance is a listing of all balance sheet accounts containing non-zero balances at the end of a reporting period. The post-closing trial balance is used to verify that the total of all debit balances equals the total of all credit balances, which should net to zero.

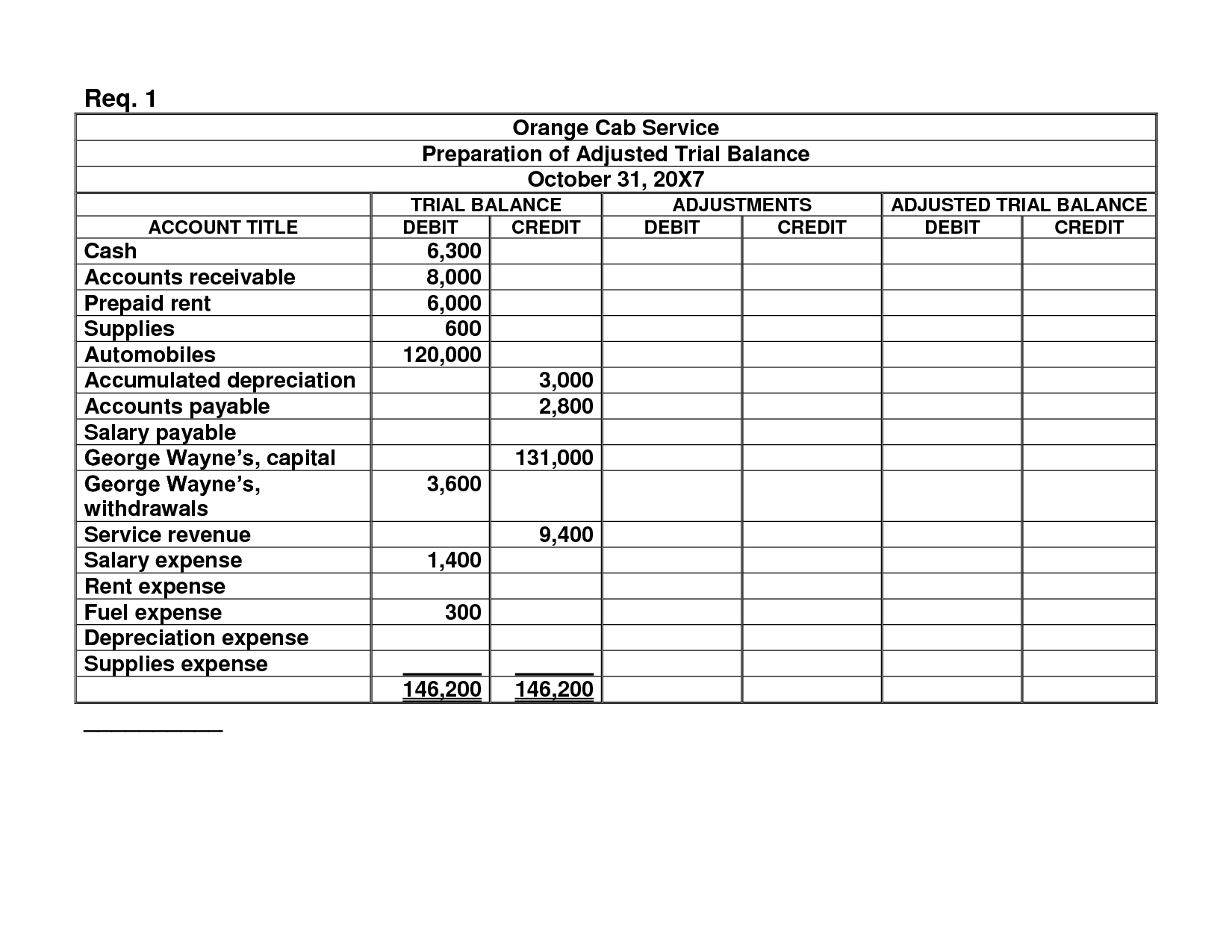

Typically, the heading consists of three lines containing the company name, name of the trial balance, and date of the reporting period. Like all financial reports, a post closing trial balance should be prepared with a heading. The preparing adjusted trial balance comes after recording and post-adjusting entries. The main purpose is to test equality between debit and credit after preparing the adjusting entries.

Let’s look at what a trial balance is, how it works, the various types, and examples. The accounting cycle ends with the preparation of a post-closing trial balance. This trial balance lists the accounts and their adjusted balances after closing. At the bottom of the debit balance and credit balance columns will be a total for each. When accounting software is used, the totals should always be identical. Notice that this trial balance looks almost exactly like the Paul’s balance sheet except in trial balance format.

Remember that closing entries are only used in systems using actual bound books made of paper. In any case, they are an important concept and they officially represent the end of the process. Once we are satisfied that everything is balanced, we carry the balances forward to the new blank pages of the next (now current) year’s ledger and are ready to start posting transactions.