By leveraging advanced workflow management, the no-code platform, LiveCube ensures that all closing tasks are completed on time and accurately, reducing the manual effort and the risk of errors. Organizations can achieve a 40% increase in close productivity, resulting in a more streamlined financial close process and allowing your team to focus on more strategic activities. Lastly, if we’re dealing with a company that distributes dividends, we have to transfer these dividends directly to retained earnings. Notice that the balance of the Income Summary account is actually the net income for the period. Remember that net income is equal to all income minus all expenses.

Monthly Financial Reporting Template for CFOs

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. The term “net” relates to what’s left of a balance after deductions have been made from it. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

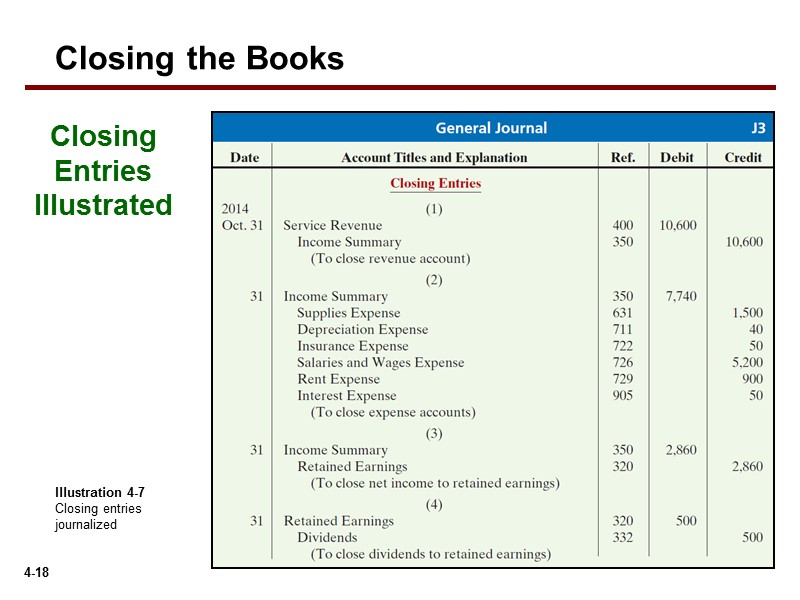

Step 1: Close all income accounts to Income Summary

Accountants may perform the closing process monthly or annually. The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts. When making closing entries, the revenue, expense, and dividend account balances are moved to the retained earnings permanent account. If you own a sole proprietorship, you have to close temporary accounts to the owner’s equity instead of retained earnings. The statement of retained earnings shows the period-ending retained earnings after the closing entries have been posted.

In which journal are closing entries typically recorded?

Organizations can achieve up to 95% journal posting automation with a pre-filled template, reducing errors and discrepancies and providing a reliable view of financial data. Once we have made the adjusting entries for the entire accounting year, we have obtained the adjusted trial balance, which reflects an accurate and fair view of the bakery’s financial position. Now, it’s time to close the income summary to the retained earnings (since we’re dealing with a company, not a small business or sole proprietorship).

Ask a Financial Professional Any Question

- The balance in the Income Summary account equals the net income or loss for the period.

- By leveraging advanced workflow management, the no-code platform, LiveCube ensures that all closing tasks are completed on time and accurately, reducing the manual effort and the risk of errors.

- However, the cash balances, as well as the other balance sheet accounts, are carried over from the end of a current period to the beginning of the next period.

- The income statement summarizes your income, as does income summary.

- It can also create errors and financial mistakes in both the current and upcoming financial reports, of the next accounting period.

- This is closed by doing the opposite – debit the capital account (decreasing the capital balance) and credit Income Summary.

The income summary account is then closed to the retained earnings account. In essence, we are updating the capital balance and resetting all temporary account balances. Once you have completed and posted all closing entries, the final step is to print a post-closing trial balance, and review it to ensure that all entries were made correctly. The eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the ledger.

Temporary vs Permanent Accounts

There are various journals for example cash journal, sales journal, purchase journal etc., which allow users to record transactions and find out what caused changes in the existing balances. Closing entries are mainly used to determine the financial position of a company at the end of a specific accounting period. The retained earnings account is reduced by the amount paid out in dividends through a debit and the dividends expense is credited. However, some corporations use a temporary clearing account for dividends declared (let’s use “Dividends”).

The main purpose of these closing entries is to bring the temporary journal account balances to zero for the next accounting period, which keeps the accounts reconciled. Notice that the balances in the expense accounts are now zeroand are ready to accumulate expenses in the next period. The IncomeSummary account has a new credit balance of prepaid expenses meaning journal entry and examples $4,665, which is thedifference between revenues and expenses (Figure5.5). The balance in Income Summary is the same figure as whatis reported on Printing Plus’s Income Statement. To further clarify this concept, balances are closed to assureall revenues and expenses are recorded in the proper period andthen start over the following period.

These entries are made to update retained earnings to reflect the results of operations and to eliminate the balances in the revenue and expense accounts, enabling them to be used again in a subsequent period. Closing all temporary accounts to the income summary account leaves an audit trail for accountants to follow. The total of the income summary account after the all temporary accounts have been close should be equal to the net income for the period.