Then all the above categories of payments are deducted from the journal. So wages, stationary, followed by tea and refreshments and so on. A neutral person is engaged to check whether the petty cashier uses the petty cash properly.

In this way, at the beginning of every month, the petty cashier will possess $500 as an imprest fund to meet up day to day expenditures. Record the following transactions in an analytical petty cash book for the month of January 2019. Record the following transactions in a simple petty cash book for the month of January 2019.

Following is the Receipts and Payments Account of Bharti Club …

Some examples of petty cash expenses include stationery costs, printing costs, and regular plumbing works. These expenses might be recurring or might be one-off, but the common denominator is that they are insignificant to be kept under the track in a separate account. It includes balances and transactions, which, if otherwise individually managed, might be harder to keep track of. Hence, all such transactions are booked under the petty cash account. A petty Cash Book can, therefore, be described as a ledger that lists down all the petty cash expenses that the company has incurred over a specific course of time. We have all seen that diary our local shopkeepers use to jot down each item they sell daily.

Moreover, it’s practical to highlight the net balance whenever we’re running low. In this step, we’ll fill the net balance in red color whenever it’s below $500. In conclusion, it is a vital part of every organization’s financial management, and it is unavoidable. You can be sure that no amount digits were altered in the book and that all expenses were compliant with the spending policies.

What Are the Two Components of a Cash Book?

Expense management solutions like Happay offers prepaid cards and software to help businesses with multiple locations, offices, and outlets keep track of their small amounts of cash. Therefore, the balance c/f of $4650 in cell H16 represents the remaining cash balance of $11000. The business will always have streamlined expense management and error-free audits if everything is divided from the top down with the same policies company-wide. Having paper documents and receipts for petty expenses might sound negligible; however, with these, you can always tally up the amount that was allotted and the expenses that were made.

Depending on the user, petty cash books can follow a single, double, or triple column format. A cash book is an essential tool for all sizes of business organizations and individuals, irrespective of single, double, or triple columns on both sides of the T-table. All three formats use cash columns, even if it’s petty or regular. A petty cash book makes recording and maintaining everyday transactions a piece of cake.

Software for managing cash flow

Big organizations have cash books where they record their revenues and expenditures. However, there are sundry expenses that need to be paid via cash only. But, recording them in the main cash book is a burden and requires time and labor. We can keep the frequent, quick, and small payments recorded in the petty cash book. A petty cash book records everyday minor expenditures such as office supplies, refreshments, or travel expenses. It allows easy tracking and keeps these small transactions in order.

CBSE Class 9 Elements of Book Keeping and Accountancy Syllabus 2023-24, Download in PDF – Jagran Josh

CBSE Class 9 Elements of Book Keeping and Accountancy Syllabus 2023-24, Download in PDF.

Posted: Tue, 09 May 2023 07:00:00 GMT [source]

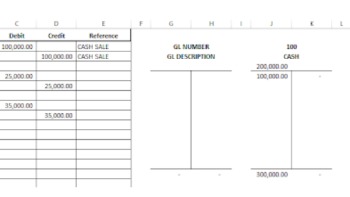

A cash book is a first and foremost book in the books of accounts that manages only the cash transactions of a company. It is a T-shaped table with two sides, viz., Debit Side (on the left) and Credit Side (on the right). All the expense receipts of petty cash vouchers have to be signed by the cashier and the one receiving them. This means that the total spend must be equal to the total amount allotted in the beginning. This amount is given as petty expense budget is called imprest cash.

Step 1: Funds creation

Petty cashbook has two main sides, namely Debit Side abbreviated as DR and Credit Side abbreviated CR. 3.High chances of cash misuse especially if the few cashiers collude due to lack of separation of duties. Average acceleration is the object’s change in speed for a specific given time period. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

- So, if the business finance heads have put restrictions on some category of expenses or specified a particular vendor for specific expenses, all those rules will be duly followed.

- Your information is kept secure and not shared unless you specify.

- 1.It is easy to maintain for it does not require a lot of balancing of the amount spend and the amount to be topped up by the main cashier to maintain a cash float.

- All petty expenses must be made within that limit, and a detailed report must be submitted to the head.

- As a result, companies keep and maintain a petty cash book, so all such transactions, which are small or insignificant in nature, can be recorded under one head.

Under this system, it is possible to ascertain and know the number of expenses of the same nature of each column separately for a particular period. It depends on the nature, volume and necessity of transactions of a business organization. The following are the advantages of a firm using imprest system as compared to the ordinary petty cash system.

Petty cash systems

It depends on several factors, such as the demand for petty cash during regular operation. However, we also need to consider the risk of fraud if the float amount is too high as the payment through petty cash does not go through management approval. The cashier can only spend what they have (float current liabilities: definition, how it works & liability list amount) and will claim what they already spend. The replenished form should attach with the supporting documents as the top management did not approve of the individual transaction, so he needs to approve the total amount. This system will only allow the petty cash amount within the float amount.

What is petty cash? – Simply Business knowledge

What is petty cash?.

Posted: Tue, 24 May 2022 07:00:00 GMT [source]

In the petty cash book with imprest system approach, the main cashier assess the total expenses paid for by the petty cashier and then reimburse an equivalent amount. That is, at any time, the total of petty cash balance and all expenses that have not been reimbursed to the petty cashier is equal to the agreed float. Columnar petty cash books consist of both debit and credit sides. In this book, there are many columns which record day to day expenditures. Learn about petty expenses, what is a petty cash book, petty cash book format, types of petty cash books, and much more.

These surprise checks are important to check if any employee is getting away with fraud and that everything is maintained according to the process. In some cases, the amount of expenditure is so small that issuing a cheque for it is quite inconvenient and unnecessary. About the Author – Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

1.The imprest system is an arrangement which brings down the probability of misuse of cash. For instance, the float can be immediately reduced if it is found to be more than enough for the agreed period. 5.Low probability of losing cash through colluding for the staff dealing with petty cash are view and each can monitor every cash movement. For this purpose, he is given a small amount and a separate book to record these small payments. Follow Khatabook for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.