This set of slides, handouts, and notes takes students through how to use credit wisely. Kids are going on a cross-country trip with this online game, and they need to figure out how to budget for it. Then, they hit “See Reality”, and are shown how to correct or show off, their money reality is from their life choices. In other words, it shows them how much they would have to work and how much they would need to earn in order to afford the lifestyle choices they’ve just made. For example, when I played, I was a bicycle repairer with an annual income of $26,990 (monthly take-home pay of $1,174).

- They take a turn with the fortune teller again, who spits out a a real-life scenario.

- Each child gets a Budget Options Sheet, which has three different options for each budget category that they can choose from.

- But with a competitive money-saving game, along with self-control, you can still achieve a successful budgeting plan.

- Alternatively, if you have more foresight and greater flexibility, you can employ a few different approaches to assessing your budget.

Financial Literacy Activities for High School Students (PDFs)

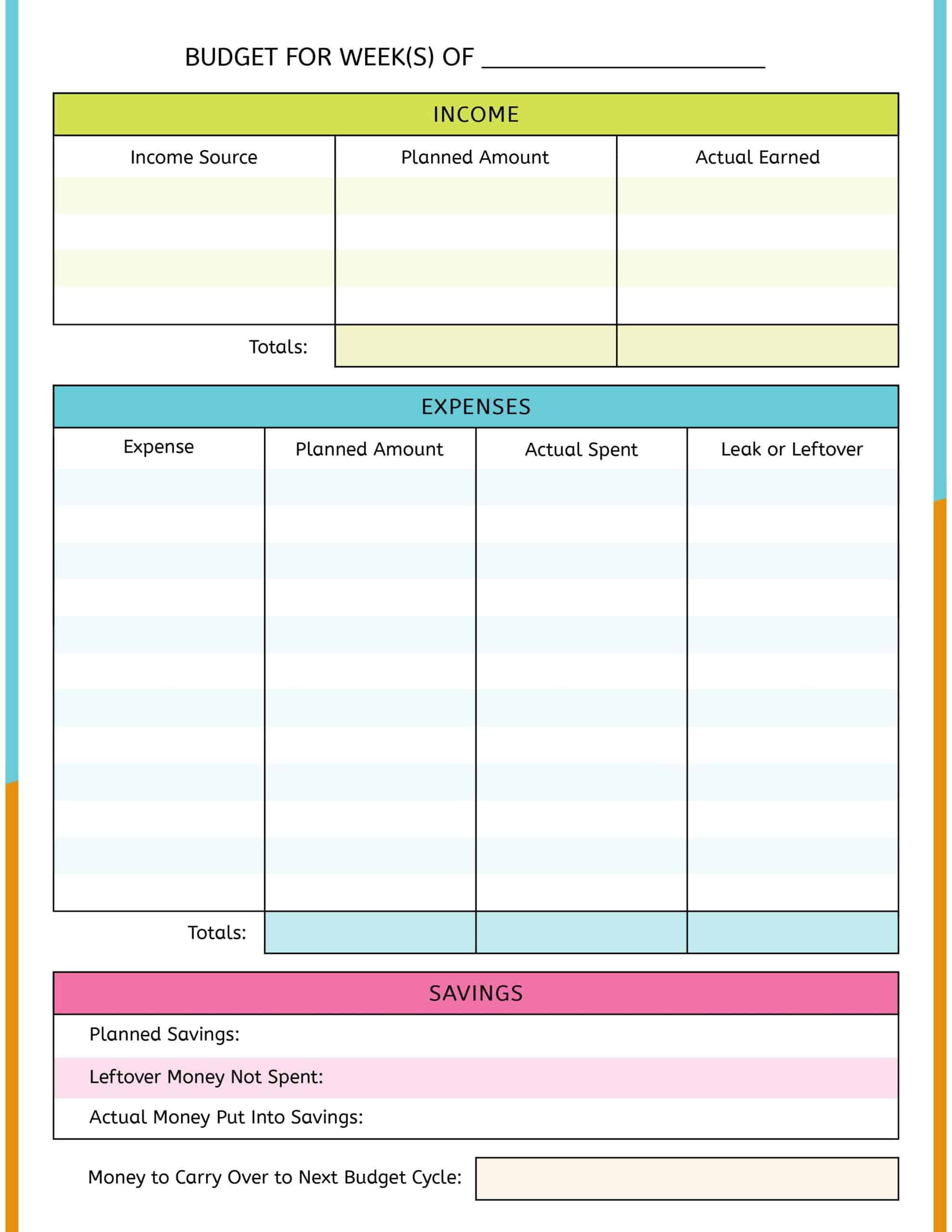

Free budget printables are just another way to make budgeting and tracking your money more successful and more fun. These free printable budget worksheets are available in three different designs as well. It only makes sense that Mint, creator of one of the most used online budgeting apps, would have free printable budgeting worksheets available.

Plus, get all the best teaching tips and ideas straight to your inbox when you sign up for our free newsletters!

We also include budgeting learning objectives for each grade, which are pulled straight from the National Standards for Personal Finance Education. To create this will i owe the irs tax on my stimulus payment game, list income types and expenses on index cards. On each card, write a sentence explaining the money coming into or going out of the imaginary budget.

Types of budgets

Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities. At no added cost to you, some of the products mentioned below are advertising partners and may pay us a commission. Is to end the game with $450 in savings PLUS a “Well Being” Factor of 96 or higher.

Adult educators can assist their grown students in developing healthy money habits, and identifying unnecessary expenditures, by engaging them in money management and budgeting games. These games allow adult learners the opportunity to practice money management skills in an enjoyable and cooperative fashion. You can find the materials you need to teach budgeting, regardless of your students’ levels. Here are budgeting lessons, worksheets, activities and games, and some key tips – by grade.

The Uber Game

Explore other options, such as seeking expert financial advice or resources that can help you pay bills. And just part of the banking activities for kids and teens to learn about. Hit the Road is a game presented by the National Credit Union Association (NCUA). In the game, you and your best friends are on a cross-country road trip to Colorado. You have a set budget for the trip and you make decisions along the trip. All your purchases need to fit within your budget or you won’t have enough money to make it to Colorado.

This one has your students creating a Statement of Financial Position, meaning they’ll basically fill out their net worth to date. From learning how to rent an apartment, to learning how to decide on a big purchase decision – these lessons help prepare teens for real-life scenarios they’ll face in a few short years. Awesome – let’s get you some free financial literacy activities for high schools (PDFs included). This is a budget simulation game, where teens are given a $300/month income to use to make financial decisions.

And that’s totally okay – I just want to give you the tools you need to teach a baseline level of budgeting for everyone you work with. Some students will start off at Level 2 (since their parents already taught them how to do this at home, or they pick things up really quickly), while others will linger in Level 1 Budgeting for a year or more. It’s always good to understand the end goal (even if your students won’t reach these for years into the future). We teach, learn, lead and serve, connecting people with the University of Wisconsin, and engaging with them in transforming lives and communities. I’m going to keep my eyes out for the best teenage budget calculators, and even adult ones that can be adapted for teens to use.

But with a competitive money-saving game, along with self-control, you can still achieve a successful budgeting plan. This activity will encourage group discussions and make sure that the knowledge of budgeting is exchanged in the process. Moreover, this activity will make sure that individuals know what their needs are, and as per their needs, how they need to plan their budget. Here are some great journal topics for high school, including the subject of money. Your students are tasked with writing a creative savings comic strip, all around different characters working through an important lesson about saving money.